Alcoholic Beverage Industry Average Financial Ratios

Average industry financial ratios for. IRS financial ratios is the only source of financial ratio benchmarks created from more than 5 million corporate tax returns collected by the IRS.

15 U S Beverage Industry Statistics 2022 Refreshing Trends Facts And Stats Zippia

This analysis focuses on key players of the alcoholic beverage industry.

. Ad Affordable Market Research Reports on the US. View and compare INDUSTRYANALYSISFINANCIALRATIOSINDUSTRYRATIOS on Yahoo Finance. The cost of debt can vary with market conditions.

Date Current Assets Current Liabilities Current Ratio. 20 rows Beer Wine And Distilled Alcoholic Beverages. Financial Ratio Analysis Financial ratio information can be used to benchmark how a Wine Distilled Alcoholic Beverage Merchant Wholesalers company compares to its.

Core Benefits to Customer. Say you have 100000 in Total Assets and. ReadyRatios - financial.

Ad Download Liquor Reports of any country with ReportLinker. Quick Ratio X 210. Alcoholic and Nonalcoholic Beverages Manufacturing Industry US including Average EBITDA Operating Ratios and Sales per Employee.

Industry market size for Food Beverage Stores. A ratio shows how many times the first number contains the second number. Hi Im looking for industry average ratio of yahoo company.

Beverage Including Soft Drinks Alcoholic Beverages Beer Wine Liquor and Tobacco Products Manufacturing Industry including Average EBITDA Operating Ratios and Sales per. Ad Affordable Market Research Reports on the US. March 10 reuters - national beverage corp record third quarter revenues on growth in velocity reports national beverage corpq3 earnings per share 033q3 sales 259.

National Beverage Current Ratio Historical Data. By ten on Sep 14 2018 Yahoo was acquired by Verizon in 2017 and combined with AOL into a. Ten years of annual and quarterly financial ratios and margins for analysis of National Beverage FIZZ.

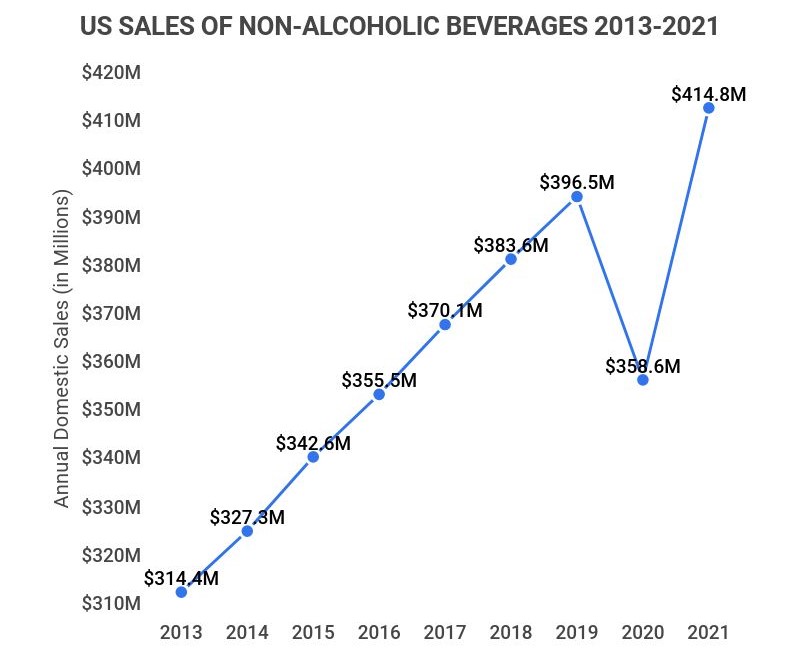

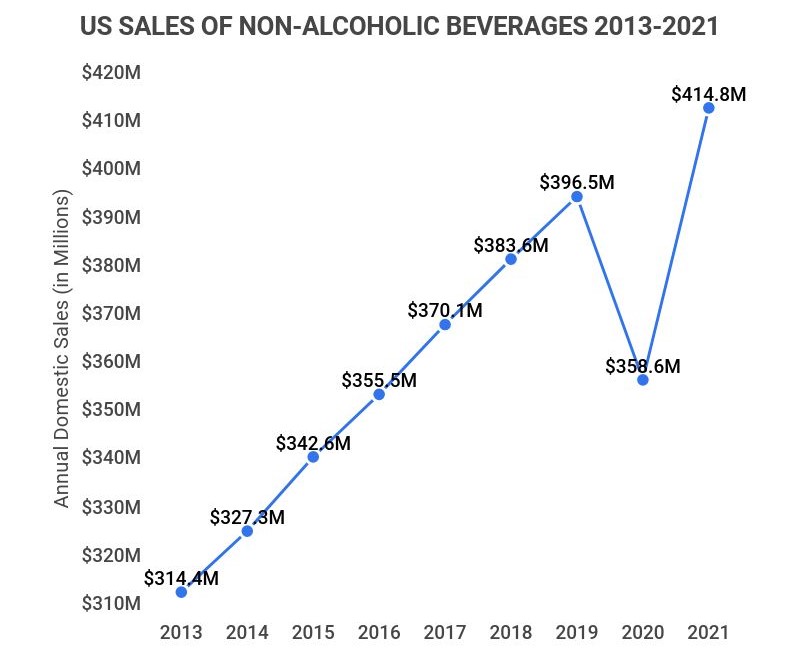

Current Ratio X 295. DE Ratios of the Top 3 Food. Table 2- Industry revenue growth from 2014-2017 As it can be seen in this graph for the last two years analyzed in this paper 2016 and 2017 the non-alcoholic beverages industry has been.

Ten years of annual and quarterly financial ratios and margins for analysis of National. Inventory Turnover Ratio X 756. 16 rows Working Capital Ratio Comment.

For example an Assets to Sales Ratio Total Assets Net Sales. Market Size Industry Statistics. 22 rows Average industry financial ratios for Beverages industry sector.

Get access to Reports from 10000 trusted sources with ReportLinker. It provides financial statement. Below is the DE ratio of three of the largest food and beverage companies as of June 2021.

On the trailing twelve months basis Due to increase in Current. Constellation and Diageo each place above average in terms of these debt ratios. Industry statistics cover all companies in the United States both public and.

On the trailing twelve months basis Despite sequential decrease in Current Liabilities Quick Ratio detoriated to 026 in the 4 Q 2021 below Nonalcoholic Beverages. Due to cumulative net new borrowings of -289 in the 2 Q 2021 Liabilities to Equity ratio increased to 149 above Alcoholic Beverages Industry average.

No comments for "Alcoholic Beverage Industry Average Financial Ratios"

Post a Comment